Almost everything you see this holiday season will encourage you to spend money. You may feel pressured to buy the “best” gifts or top gift giving from previous years. In fact, according to the Consumer Federation of America, 1/3 of us planned on spending more during the holidays in 2013 than we did in 2012.

I’m here to tell you that you absolutely do not need to blow your budget this holiday season. Let’s make a commitment right here and now to be smart in our spending and keep to our spending and savings plan. Say it with me: “I will not break my budget this holiday season.”

OK, with that out of the way we can now focus on how to make that happen.

First, take a look at your financial situation and the goals you have:

- Focus on what you really want – I’m not talking about gifts or presents here but rather items like a down payment for a house, saving for a child’s education, or building an emergency fund.

- Create a spending and savings plan to reach your goals – Don’t wait until the New Year, after you have spent all that money over the holidays, to make a resolution to get your finances together. Do it now before you start any holiday spending or incur any unnecessary debts so you know exactly how much you can spend.

- Take the America Saves Pledge – Those who make a commitment to themselves and their family to save usually save more than those who don’t. Make your commitment today and get monthly advice and support from America Saves while you save money.

Once you know how much you have to spend, use these tips and ideas to keep spending within your budget:

- Form gift exchanges – This many not work with all families, but it should definitely work with friends and coworkers. After all, reducing the number of your gifts you have to buy can save you a lot of money.

- Make homemade gifts – Think bath products, movie night packages, remote holders, drink koozies, and candles. Pinterest has so many great ideas to inspire you. You can knit, sew, glue, fold, stir, or recycle a handmade gift that keeps your spending low and your personal investment high.

- Share a skill – Instead of giving a coupon good for one dog walk or one house cleaning (though those are valuable gifts to give, too!), offer to teach your grandmother or an uncle how to use Twitter or arrange for a special night where you can teach a niece or nephew how to cook a meal.

You don’t have to let this holiday season break the bank. Remember your personal savings goals and get creative with gift giving this year to reduce spending and save money.

Katie Bryan works for America Saves, managed by the nonprofit Consumer Federation of America (CFA), which seeks to motivate, encourage, and support low- to moderate-income households to save money, reduce debt, and build wealth. Learn more at americasaves.org.

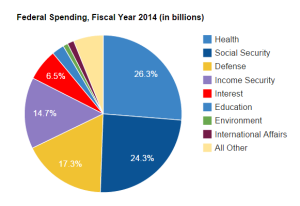

the budget includes paying for military expenses on foreign soil, expenses to keep our home land safe, and also perks for soldiers such as the G.I. Bill.

the budget includes paying for military expenses on foreign soil, expenses to keep our home land safe, and also perks for soldiers such as the G.I. Bill.